Malaysia has a withholding tax or Withholding Tax WHT. Generally any person making certain payments such as royalties interest contract payments remuneration to a public entertainer technical and management fees to non-residents is required to remit the tax deducted at an applicable rate ie.

Cukai Pendapatan How To File Income Tax In Malaysia

Any tax resident person who is liable to make certain specified types of payments to a non-resident is required to deduct withholding tax at a prescribed rate applicable to the gross payment and remit it to the Malaysian IRB within one month of paying.

. Interest on loans given to or guaranteed by the Malaysian government is exempt from tax. However non-arms length payments are subject to a 25 withholding tax. If the gross income is higher than P720000 a 15 withholding tax based on the gross income should be applied.

Malaysia offers a wide range of tax incentives for the promotion of investments in selected industry sectors which include the traditional manufacturing and agricultural sectors as well as other sectors such as those involved in Islamic financial services ICT education tourism healthcare as well as research and development. There are four ways you can reduce the amount of withholding tax on your. 0 0 or 15 10.

Tax exemption for individuals earning less than P250000. 0 0 0. Withholding tax is a method of collecting taxes from non-residents who have derived income which is subject to Malaysian tax.

A tax withholding agent. The complete texts of the following tax treaty documents are available in Adobe PDF format. If you have problems opening the pdf document or viewing pages download the latest version of Adobe Acrobat ReaderFor further information on tax treaties refer also to the Treasury Departments Tax Treaty Documents page.

The withholding tax rate on dividends under the terms of Canadas tax treaties generally. Yes businesses are required to self-account for Service Tax on imported services which are in the scope of Service Tax. Does a reverse charge or indirect tax withholding mechanism apply.

Malaysia Last reviewed 14 December 2021 Resident. Withholding tax to the Inland Revenue Board of Malaysia IRBM within one month from the date of paying or crediting. Dividend Withholding Tax and share what you have to note if youre thinking of diversifying into the US.

Those who make payments payers in Malaysia withhold a certain percentage of income earned by non-residents payees. LHDN must be. An individual earning less than P250000 a year is exempted from withholding tax where the income is coming only from a single payor ie.

Here we discuss the US. 4 Dividends subject to Canadian withholding tax include taxable dividends other than capital gains dividends paid by certain entities and capital dividends. Some treaties provide for a maximum WHT on dividends should Malaysia impose such a WHT in the future.

Exemption from withholding tax as a result of other exempting provisions of a tax convention other than those given above in codes I and P through R. Sales Tax and Service Tax were implemented in Malaysia on 1 September 2018 replacing Goods and Services Tax GST. Malaysia has no WHT on dividends in addition to tax on the profits out of which the dividends are declared.

Exemption from withholding tax on payments of certain reasonable travel expenses and per diem amounts reimbursed to a non-resident actor. Source How to Pay Less Dividend Withholding Tax. Withholding tax WHT rates Dividend interest and royalty WHT rates for WWTS territories Statutory WHT rates on dividend interest and royalty payments made by companies in WWTS territories to residents and non-residents are provided.

Types Of Withholding Tax Malaysia Sap Simple Docs

Malaysia Tax Asean Business News

Best Payroll And Tax Services In Netherlands Payroll Financial Tax Services

Notice Withholding Tax 10 Enagic Malaysia Sdn Bhd

Malta S Double Tax Treaties January 2016 Withholding Tax Malta

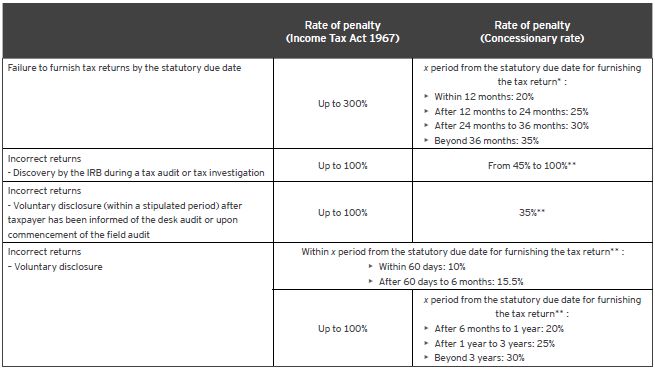

Tax Amnesty Waiver And Remission Of Tax Penalty Withholding Tax Malaysia

2022 Updates On Real Property Gain Tax Rpgt Property Taxes Malaysia

Details Of 2 Agent Commission Withholding Tax L Co

Tax Base Definition What Is A Tax Base Taxedu

Payroll And Tax Services In Belgium Payroll Tax Services Financial

Types Of Withholding Tax Malaysia Sap Simple Docs

Arena Multimedia Lahore Center 8 Days Adobe Photoshop Professional Course With Raheel Ahmed Baig On 7th Janua Arena Multimedia Network Marketing Solutions

Bbva Bank Statement Template Mbcvirtual Statement Template Bank Statement Templates

U S Dividend Withholding Tax What Singapore Investors Must Know

Laravel Training In Karachi 3d Educators Information Technology Technology Systems Development

Payments That Are Subject To Withholding Tax Wt

Malaysia Tax Penalty For The Late Payment Of Tax

- periksa no plat

- epoxy table top price

- ruang tamu biru gelap

- sahabat setia mudah

- sogo parking rate

- bilik kesihatan sekolah

- surat perjanjian hutang piutang tanpa jaminan

- allianz panel clinic

- apartment for rent in klang

- contoh surat keizinan suami egtukar

- desain papan nama sekolah

- bus to langkawi from kl

- contoh borang ahli koperasi

- mrt line 3 route map malaysia

- model kereta proton preve

- undefined

- ikea malaysia table mirror

- withholding tax malaysia

- pelan rumah 4 bilik

- gambar pola kereta kertas